Modular Study Design

The Future of CX Measurement

Data collection, access to audiences, and operational logistics have evolved, and so must the measurement ecosystem. JD Power recognizes the need to proactively adapt to ensure continued success and, in response, will be moving to a modular study design.

What is Modular Study Design?

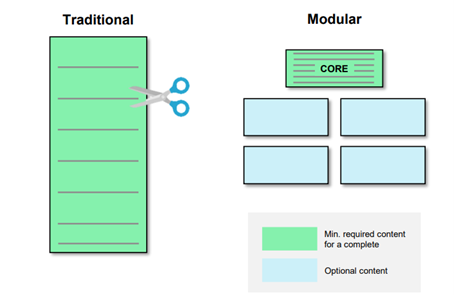

Modular study design is a methodology that enables us to deconstruct a traditional survey allowing the separation of the study’s core questions and additional modules. All respondents must complete the core, which will take 10 minutes or less, and may opt to complete additional modules. Core questions remain constant regardless of redesign or changes to the modules which allows trending continuity. The result is shorter survey blocks, better user experience, and improved access to sample.

The Benefits of Modular Study Design

The modular design helps us address common market research challenges:

As customer experiences change →

Insights must be actionable →

Trending of data is critical →

Cross-industry insights are invaluable →

A view of the holistic experience is required →

Survey instruments must be accessible to audiences →

Frequently Asked Questions

We invite you to explore the answers to commonly asked questions, and please do not hesitate to reach out if your question is not answered below.

The Index is now based on six to eight Dimension ratings that form the composite Overall Satisfaction score. The Index is moved to the core of the survey along with other essential measures (e.g., demographics, NPS), and the content in the core of the survey remains constant over time.

The new measurement is meant to fall between JD Power’s traditional method and NPS® to bridge the concrete, experiential, transactional data with abstract, emotional, and relationship data.

Modular studies will transition to the fully anchored poor-to-perfect rating scale. After conducting multiple rounds of scale testing, including emoji-based, 7-to-10-point alternative scales, and fully labeled options, the 6-point, fully anchored, poor-to-perfect scale was found to be the ideal rating scale. This scale provides better discrimination than the current 10-point scale, is easier for mobile participants to use, displays horizontally for desktop, and displays vertically for mobile.

The goal of the top anchor is that it should be used very rarely--only if your experience or the product is truly exceptional. We tested other top anchor labels, but perfect worked the best. Even using the word “perfect,” we still get about 16% of respondents selecting this top anchor point.

In our legacy survey design, Factors (typically composed of 3-6 rating attributes) were the rating items that rolled up to the Overall Satisfaction Index score. In Modular design, Dimensions are the rating items that roll up to the Overall Satisfaction Index score. They are placed in the core after NPS. Factors are still present in modular design, but they no longer contribute mathematically to the Index score. They are contained within the modules of the survey and help explain performance in relevant Dimensions.

During the first year with the new index, previous factor questions will be retained in modules for purposes of using a bridging equation between the models. The bridging equation will be applied to the historical trend lines so that historical trends can be estimated based on the new index and scale. The specific details of each study do vary and, in some studies, the transition to modular coincides with a full content redesign and limited or no trending of prior content.

Current study content will be broken into modules, thus maintaining robust and detailed content. Driver analyses using attribute ratings and KPIs will still be provided and with the added flexibility of the modules, these analyses can be extended and provide deeper insight than before.

For respondents who opt to complete less than all modules, there will be "incomplete" (missing) data for modules that are not completed. This makes the sample bases analyzed different across modules. However, we have not found this to be detrimental to our analytics, and key analyses can still be conducted to understand what matters most to customers. Sample sizes at the module level are still sufficient for analysis and deriving insight related to what is important to customers and how a brand is performing.

If you have any other questions, please reach out to your Account Executive or visit our website for additional study details.