The Ultimate Playbook for Modernizing P&C Performance

Introduction

The insurance industry is undergoing significant transformation, fueled by changes in automotive markets, evolving customer preferences, economic impacts, and increasing environmental risks. Recent years have posed unprecedented challenges for insurers, particularly in the wake of the pandemic. In 2020, with fewer people driving, there was a period where money was returned to consumers. However, with driving patterns returning to pre-pandemic levels, claims are increasing in cost, frequency, and severity. This shift exposed the critical importance of precise pricing, particularly as insurers were forced to adjust premiums to remain profitable.

This playbook is designed to guide P&C insurance professionals through the intricacies of operational optimization during these challenging times. By the end of this guide, you will be equipped with strategies to improve pricing accuracy, enhance your acquisition process, maximize your retention, and leverage industry-leading insights to stay ahead in the competitive landscape.

We’ve organized this playbook into the following categories to help you target priority areas:

The J.D. Power Ultimate Playbook for Modernizing P&C Performance is a comprehensive guide to modernizing operational processes in the P&C insurance sector.

Pricing Modernization

Overview

Pricing accuracy is critical for growth and profitability. Traditional pricing and valuation methods, which rely on limited feature data and generic model factors, often miscalculate risk. In 2023, this miscalculation led to an industry combined ratio for private passenger auto of 1051, a trend that will persist unless something changes. Carriers that continue to rely on antiquated methods for determining policy prices will be outpaced by those that embrace modern, innovative techniques.

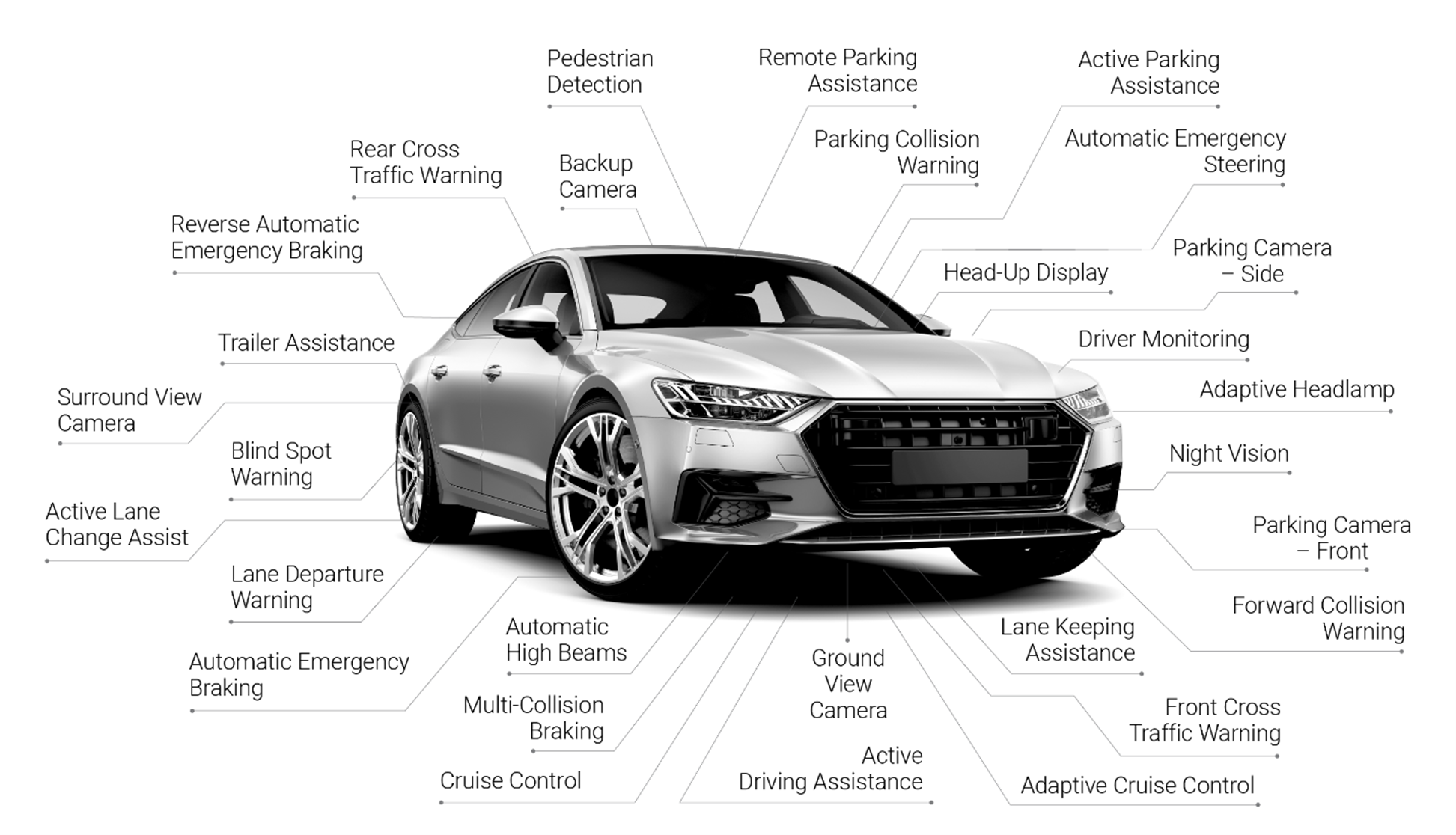

Pricing modernization requires updating pricing strategies to better reflect real-time market conditions and consumer behavior. This is particularly crucial with the advent of Advanced Driver Assistance Systems (ADAS) and the growth of electric vehicles (EVs) in market, which are reshaping automotive insurance dynamics. Today’s vehicles are increasingly sophisticated and technologically complex, and the used car market is facing a level of volatility not seen in decades. As a result, knowing the vehicle you are insuring is more important than ever. This includes a detailed understanding of how it can be built, how it is actually configured, and what it’s worth today, tomorrow, next year, and at each subsequent policy renewal.

Shift to Enhanced Vehicle & Demographic Data

Industry leaders are increasingly turning to detailed vehicle data to refine their pricing models. Leveraging expanded vehicle-specific data helps carriers more accurately assess risks and offer tailored pricing, strengthening their competitive position

A key vehicle-specific data source that is enhancing pricing algorithms is the full 17-digit VIN. Real-time and detailed 17-digit VIN data from vehicles provides insights into driver behavior, vehicle usage, and vehicle features [see exhibit below], leading to more accurate risk assessments and more accurate policy pricing. Evaluating specific vehicle features on the exact car being insured enables carriers to more competitively price auto premiums by identifying the installed features that mitigate loss and reduce risk. Historical auto claims and 17-digit VIN-specific features can be studied together to identify active and passive safety features, expensive-to-replace components, and theft-preventative measures. This analysis can then be integrated into quoting algorithms for automatic discounts at the point of shopping.

In addition to vehicle specific data, household demographic data also plays a role in improving pricing. By incorporating household level data, you gain deeper insight into the value of each household, enhancing pricing accuracy. This approach assigns a specific premium dollar amount to each individual household, rather than relying solely on an aggregated count, allowing for more precise pricing.

Ultimately, carriers that will succeed into the future will leverage data to personalize pricing based on customized vehicle configurations and customer segmentation.

1Source: A.M. Best

Product Positioning Optimization

Overview

Optimizing product positioning means defining your target audience, identifying their wants and needs, and aligning your insurance products accordingly to maximize market penetration, sales conversion, and customer retention. This process requires an understanding of brand strengths and weaknesses; target market segment expectations, trends, and characteristics; and the availability and fit of technologies like Usage-Based-Insurance (UBI).

Benchmark, Target, and Personalize

Benchmark

Target

Once you have a comprehensive understanding of your brand strengths and areas of opportunity, leverage consumer behavior data to identify where your desired customer is, what they want, and how to attract and convert them. With continued market volatility and some brands electing to exit specific markets, certain customer segments that were previously locked into policies may be open to shopping. Brands that have defined their target audience will be better equipped to develop more focused and impactful marketing strategies that directly address their needs and desires.

Personalize

What’s critical, however, when building this strategy is to ensure that your pricing and positioning approaches align perfectly.

Enhancing the Buyer’s Journey

Overview

A seamless buying journey is crucial for customer acquisition and retention. Optimizing this experience involves developing targeted acquisition strategies, enhancing touchpoints during the shopping and onboarding process, analyzing behavioral channel data, and reinforcing branding aspects.

Acquisition Strategies

Start by developing targeted acquisition strategies that align with your brand’s value proposition. Use data-driven approaches to identify and attract the right customers. For example, brands that are able to combine a competitive market view, individual shopper pricing data, and localized shopping activity will have an advantage as they have a more accurate view of their target market. Equipped with this information, you can then tailor messaging and outreach to resonate with your target audience and highlight the unique benefits of your offerings.

Channel Effectiveness

While digital self-service options continue to rise in usage, the agent remains an important part of the buyer journey for many brands. However, with digital channels managing and resolving simple requests, agents are now being faced with lengthier and more complex issues. Industry leaders understand the importance of providing a seamless cross-channel customer experience. This requires ensuring that each channel has access to the necessary customer and policy data to effectively handle requests. While enhancing digital channels is important, it is equally important that agents have proper training and are granted access to the information needed to provide exemplary services to buyers.

Behavioral Channel Data

Leverage behavioral channel data to understand how customers interact with different touchpoints. Analyze this data to identify trends and preferences, enabling you to optimize the buyer journey and identify experience gaps or areas where shoppers face challenges or abandon the process. Use insights from this data to enhance the effectiveness of both digital and in-person interactions.

Branding Aspects

Across each step of the journey, it is also important to ensure that all customer touchpoints reflect your brand’s identity and values. Consistent cross-channel branding reinforces trust and recognition. Develop a cohesive brand message that is communicated through agent interactions, digital platforms, and marketing materials. This consistency helps create a unified and memorable customer experience.

Supporting content

Channel Optimization & Relationship Management

Overview

Building and maintaining trust with customers through effective service delivery and proactive relationship management is essential for sustained business growth. Identifying the appropriate service approach for each individual customer and delivering consistent service that aligns with their preferences is crucial. Ultimately, data-driven customer segmentation should inform and manage future interactions which in turn strengthens the customer relationship.

Optimizing Service Channels

Optimizing service channels does not mean solely focusing on cost-efficiency or ease of implementation. Optimization for service channels means aligning the right channel with the customer’s unique needs and preferences. To accomplish this, you must ensure that all service channels, from personal agent interactions to digital self-service platforms, are aligned and efficient. Actions strategies leaders are deploying to achieve this include:

Implement a Triage System

Optimize Digital Interfaces

Align the Call Center

Provide Consistent and Targeted Agent Training

Digital Adoption & Containment

As we addressed above, digital channels are only valuable if people actually use them. Self-service channels can offer significant cost and time savings for both carriers and customers. However, to be effectively leveraged and frequently used, these channels must be designed with specific customer needs in mind. Once a customer fails at completing their intended interaction via digital channels, they may be hesitant to revisit that channel for future interactions. To address this, leading carriers will conduct in-depth analyses of customer behavior across their digital channels, pinpointing both utilized and underutilized features. This will enable them to identify opportunities to enhance the information offered through these channels and proactively communicate the availability and accessibility of these resources. They can continue to evaluate channel usage to ensure they are delivering both the information and experience necessary to help the user complete their task within the digital channel. For customers who are unable to complete their tasks in the current channel, they will ensure that mechanisms are in place to seamlessly transfer them to the appropriate channel, along with the necessary information to expedite their issue resolution.

Relationship Management

A strong customer-carrier relationship is cultivated through consistent and positive interactions. Leading carriers recognize that the customer lifecycle involves both low-frequency, high-complexity interactions, and more routine communications, and that success relies on deploying seamless omnichannel processes. Strategies for accomplishing this address the following:

- Knowledge Gaps: Identify and resolve knowledge gaps both for the customer and for the staff assisting them. This helps ensure that customers have a better understanding of products and outcomes.

- System Alignment: Ensure that operational systems are aligned to deliver consistent messaging and efficient service regardless of channel.

- One-Touch Interaction: While interactions between customers and carriers typically involve managing multiple touchpoints efficiently, leaders should look for ways to continually optimize channels and identify opportunities for one-touch interactions.

By analyzing every interaction point along the customer lifecycle, insurers can build stronger relationships with customers, leading to higher satisfaction and loyalty. This comprehensive approach to channel optimization and relationship management ensures that all facets of the customer experience are considered and optimized for success.

Optimizing Claims

Overview

Claims handling is a critical moment of truth in the insurance customer relationship. Effective claims management can significantly enhance customer satisfaction and loyalty, but a poor claims experience can lead customers to shop for a policy elsewhere. J.D. Power research shows that approximately 80% of customers who had a “poor” claim experience state they have already left their insurer or intend to leave at their next renewal. Industry leaders are focused on key strategies to ensure they are meeting or exceeding customer expectations at this critical moment. While many carriers are doubling down on efforts focused on accuracy, other crucial claims management strategies include deploying self-service options, providing digital tools and resources (both for internal staff and customers) and making sure the process is understood by providing clear and prompt communication.

Focusing on Consistent Levels of Service

Leveraging Digital Communication

Providing Self-Service Options

Utilizing AI and Automation

Using Data to Improve Processes

There is a plethora of data in the claims operation that can be used to continuously improve the process. A few examples would be:

Call Data: Aggregate and analyze call record data to identify reasons for calls, key topics, and even sentiment to appropriately route claims requiring higher levels of attention and resources. AI and large language models (LLMs) can be used to automate this process and even create transcripts for feedback and training. Call records can be used to train representatives on areas of customer frustration, update scripts or knowledge bases, and prioritize self-service enhancements.

Vehicle Data: Leverage more accurate vehicle-specific data to streamline the claims process. This includes integrating VIN data to identify the as-built specs of the exact vehicle being serviced or confirm the features/options/packages on a total loss valuation.

Telematics: Use telematics for proactive outreach if an incident is detected. This allows carriers to initiate the claim set-up and arrange any immediate services. Information from this process can also be used as confirmation of accident details and location.

When incorporating these strategies, insurers can optimize their claims processes, leading to enhanced customer satisfaction, reduced operational costs, and improved efficiency.

Closing Thoughts

In a rapidly transforming insurance landscape, adopting a strategic and data-driven approach to operational optimization is crucial. This Playbook provides comprehensive guidance for modernizing and optimizing pricing, underwriting, customer journeys, channel, relationship management, and claims.

Key Takeaways:

Modernize Pricing by Leveraging Better Data

Improve Product Positioning through Benchmarking and Segmentation

Optimize the Buyer Journey through Personalization and Consistency

Optimize Channels for the Customer

Build Stronger Relationships by Analyzing Interactions

Optimize Claims

By implementing these strategies, insurers can not only enhance customer satisfaction and loyalty, but also achieve sustainable growth and competitive advantage. For further reading and detailed methodologies, refer to J.D. Power industry reports and data analysis tools, which offer extensive resources and insights into insurance market dynamics.

Contributors:

Marcus Skerske

Director, Insurance Intelligence

Let's talk performance.

With decades of experience in both insurance research and analytics and vehicle data and insights, our team looks forward to discussing the latest customer experience and product data with you to help you improve performance.

More Insurance Intelligence

Latest Thought Leadership

Explore the Library

Insurance Shopping Report

Catch Up on Past Editions

Benchmarking Research

Get the Details